Appealing to millions of people worldwide for its spontaneity and ability to play on the move, casual games became so popular that they are not just drawing the engagement from the gamer, but they are also increasing revenues.

In 2018, the global games’ market reached a revenue of USD 137.9 billion, more than half of which came from mobile gaming. As a matter of fact, the combination of smartphone and tablet gaming generated USD 70.3 billion. In the case of Brazil, the country is keeping the pace with this global trend.

A Brief Report on the Brazilian Gaming Market

Brazil is one of the two leading gaming markets in Latin America, alongside with Mexico. The potential target audience and the increasing share of smartphones in mobile connections are encouraging gaming merchants to invest in this market. When it comes to gaming revenues, Brazilian gamers spent USD 1.5 billion in 2018. By 2023, mobile gaming alone will be a USD 434 million industry.

In fact, the games and the e-sports sector have the highest compound annual growth rate of the Brazilian media and entertainment spending, estimated to grow 14.7% annually from 2017 to 2022.

Who Are the Brazilian Casual Gamers?

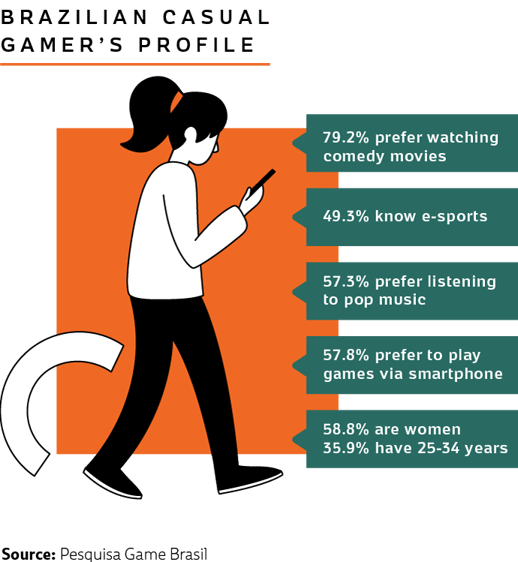

Today’s games have such a layer of engagement and involvement that they are drawing demographics that weren’t considered traditional gamers until recently, such as women. Brazil is not an exception, and women are scooping men’s lead, a shift which is due to the access and the playing of casual games in smartphones. As technology has changed the demographics’ profile, it is relevant to briefly discover who is playing casual games in Brazil.

Among Brazilians, casual games are mainly played by women (58.8%). Adults (37.7%, age 25-34) and middle age adults (34.7%, age 35-54) play the most, while teenagers and young adults (19.9%, age 16-24) and seniors (7%, over 54) play the least.

Four out of ten casual gamers state that gaming is their favorite form of entertainment, although they prefer ‘freemium’ games. Overall, Brazilians often play up to 3 times a week, spending up to 3 hours in each session.

Unveiling the Casual Games Potential

When analyzing the business potential of casual gaming, three aspects should be taken in account: 1) the consumer’s purchasing power; 2) the mobility/accessibility to play and 3) the freedom to play.

Because casual games have the features to bridge those aspects, become an asset to everyone involved in the gaming industry:

- Most casual gamers prefer to play immediately, without downloading the games; by partnering with social networks, developers can offer instant, easy and quick setup games.

- Casual gamers (as well as active ones) are attracted to free-to-play games, or “freemium”, and after experience the enjoyment they can start paying small fees to get access to other levels of involvement.

- The expansion of mobile internet gave Brazilian consumers the freedom to play anywhere and anytime, triggering the demand for casual games.

Altogether the indicated above explains the Brazilian consumers’ attraction for casual games, but when the increasing number of smartphone users in Brazil is also taken into consideration, then gaming merchants have a formula that predicts a successful return on investment.

However, the vital key to unlock this formula is investing in the games’ localization: providing the market games whose content has been adapted to the Brazilian reality and culture (i.e. Portuguese language, legal requirements, local payments, consumers’ preferences and sensitivities).

To step in the Brazilian market fully equipped to reach your consumers and obtain your market share, it is recommended that you work hand in hand with a local specialist, such as a payment aggregator. This partnership will allow you to successfully expand your business through the integration of the main local payments on your online checkout and getting a better understanding of the market’s main particularities and regulations.

BoaCompra, for example, currently offers an online checkout in Brazil that is mobile responsible. Learn more about our the potential, the trends, and the challenges of the online gaming industry in Brazil and how to expand your business in our exclusive guide: