In our previous blog, we looked at the imminent introduction of the PIX payment method by the Brazilian bank. We covered what it was, why it was developed and how it works.

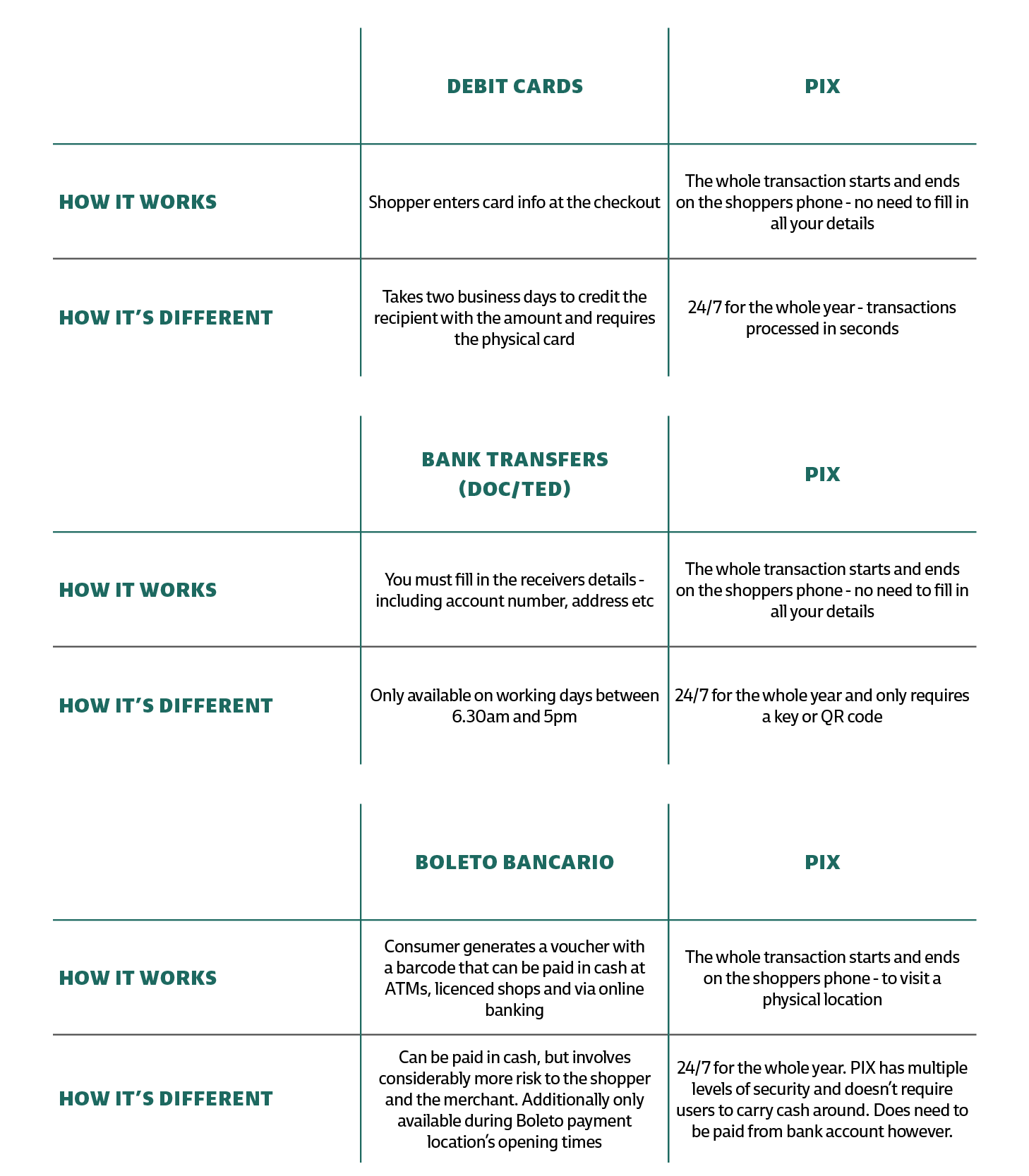

Because PIX is such a fundamental change for the Brazilian payment ecosystem, we’ll be diving into it further in this blog. In this section, we’ll be breaking down exactly how PIX differs to existing payment methods.

PIX for e-commerce consumers

We’ve explored the top four payment methods for online payments in Brazil in previous blogs. Currently, most online purchases are made with credit cards, debit cards or Boletos. BoaCompra currently offers all of these payment methods, but will also shortly be adding PIX to the selection of Brazilian payment options. Here’s how PIX compares to existing methods:

What PIX means for merchants

For those receiving payments online, PIX again operates differently to existing payment methods. Because PIX is an instant transfer, funds are processed and delivered to the recipients account in ten seconds. So, no more waiting for days for that card payment to come through.

PIX is regulated by the Central Bank, a well respected institution. The lack of privatization of the scheme means that it is open to anyone with a bank account. Thus, the option is open to more customers than any previous form of payment.

Also, by offering customers yet another payment method at the checkout, e-commerce merchants are likely to significantly increase conversion rates.

Want to read more about PIX? Check out our previous blog diving into all the basics you need to understand about PIX; and stay tuned for how (and why) to generate your PIX key.